Vix Options Expiration Calendar 2025 – 2-Year U.S. Treasury Note Continuous Contract $103.184-0.043-0.04% 5-Year U.S. Treasury Note Continuous Contract $108.750 0.109 0.10% 10-Year U.S. Treasury Note Continuous Contract $112.953 0.297 0.26 . USD/JPY, Nasdaq 100, S&P 500, Nikkei 225. Read Sunshine Profits (Paul Rejczak)’s latest article on Investing.com .

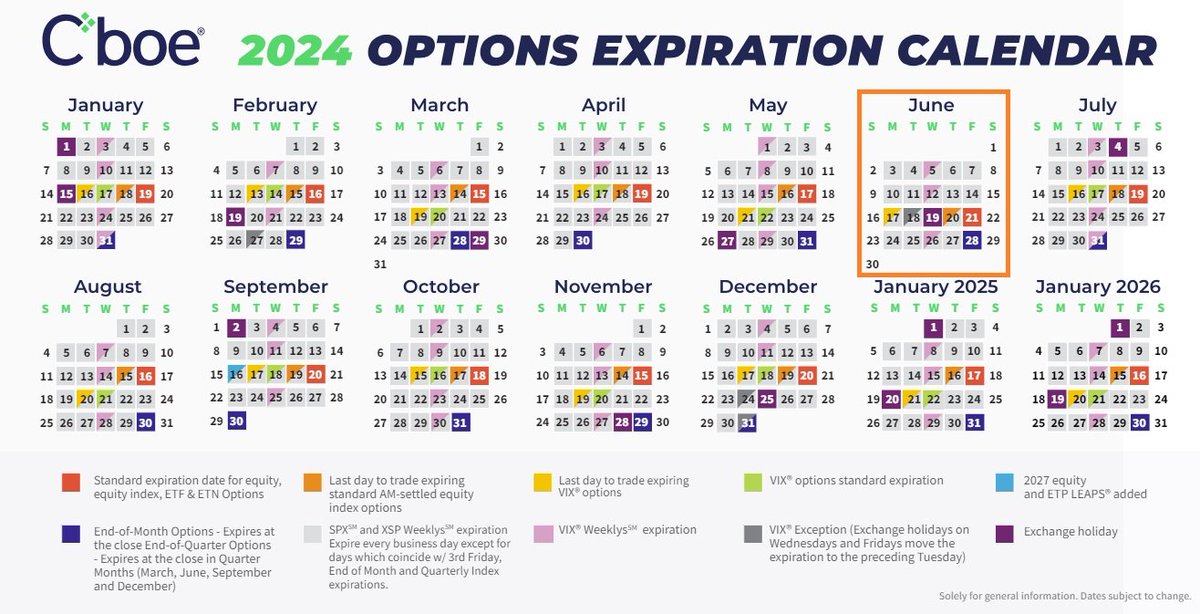

Vix Options Expiration Calendar 2025

Source : www.sixfigureinvesting.com

VIX Expiration Calendar

Source : optionstradingiq.com

Heads up next week Friday is monthly OpEx and quad witching

Source : www.forexlive.com

FRIDAY JUNE 21ST ON 2024 OPTIONS CALENDAR: Monthly equity, index

Source : www.reddit.com

Untitled

Source : www.optionseducation.org

Capital Edge on X: “Reminder that it’s quad witching on Friday

Source : twitter.com

FRIDAY JUNE 21ST ON 2024 OPTIONS CALENDAR: Monthly equity, index

Source : www.reddit.com

Options Expiration Calendar 2022

Source : printables.assurances.gov.gh

Toyota has combined two areas of expertise in the all new

Source : www.marketwatch.com

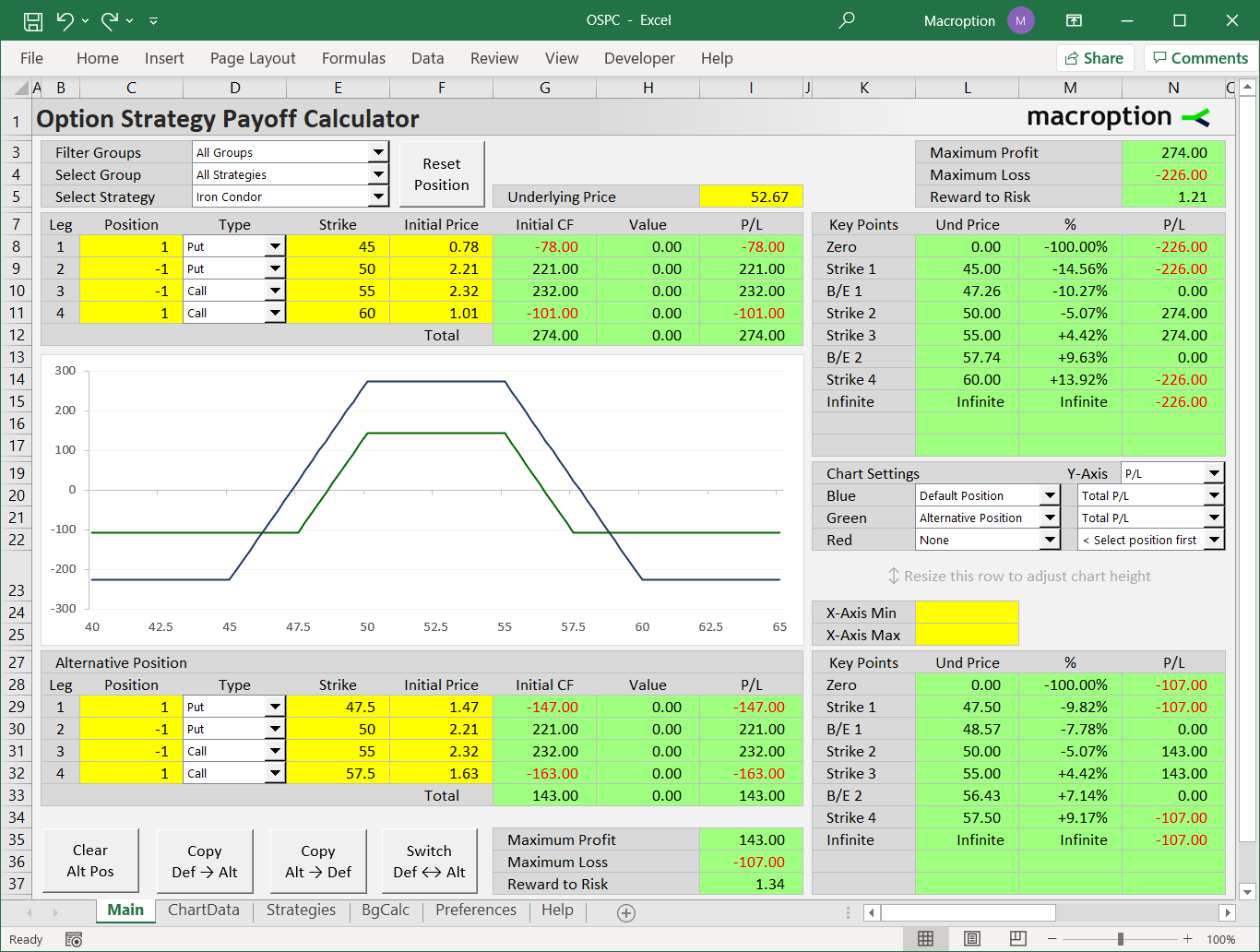

Macroption Option Calculators and Tutorials

Source : www.macroption.com

Vix Options Expiration Calendar 2025 1990 2025 Trading Calendar Equities, 2004 2025 VIX Futures/Options : Additionally, there are about 7 times more open puts than open calls at the $19.00 strike price, with 3,513 open puts compared to 500 open calls. This reflects a pronounced bearish sentiment in the . There is a wider than usual split between forecasters on the strength of oil demand growth in 2024, partly due to differences over China and more broadly over the pace of the world’s transition to .